PfM² presents an effective standalone portfolio management methodology. PfM² encapsulates globally accepted best practices from other methods and standards from PMI, AXELOS, IPMA, and the European Commission, as well as the contributions of a large number of experts, practitioners, and the broader open community over many years. The aim is to provide portfolio management guidelines that are lean, user-centric and that effectively communicate the PfM² Model to a broad and varied audience.

The PfM² Portfolio Management Methodology was developed to help Projectized, Functional and Matrix Organisations establish a management framework for the effective management of their portfolios. PfM² portfolio components can be programmes, projects, products and services.

PfM² promotes portfolio management as an enabler and not just as another layer of control and bureaucracy and aims for organisational effectiveness without increasing complexity. Its model advocates the implementation of portfolio management with a fractal model at global and local levels and aims to make portfolios useful at every level of the organisation.

Portfolio Management enables the effective implementation of strategic objectives.

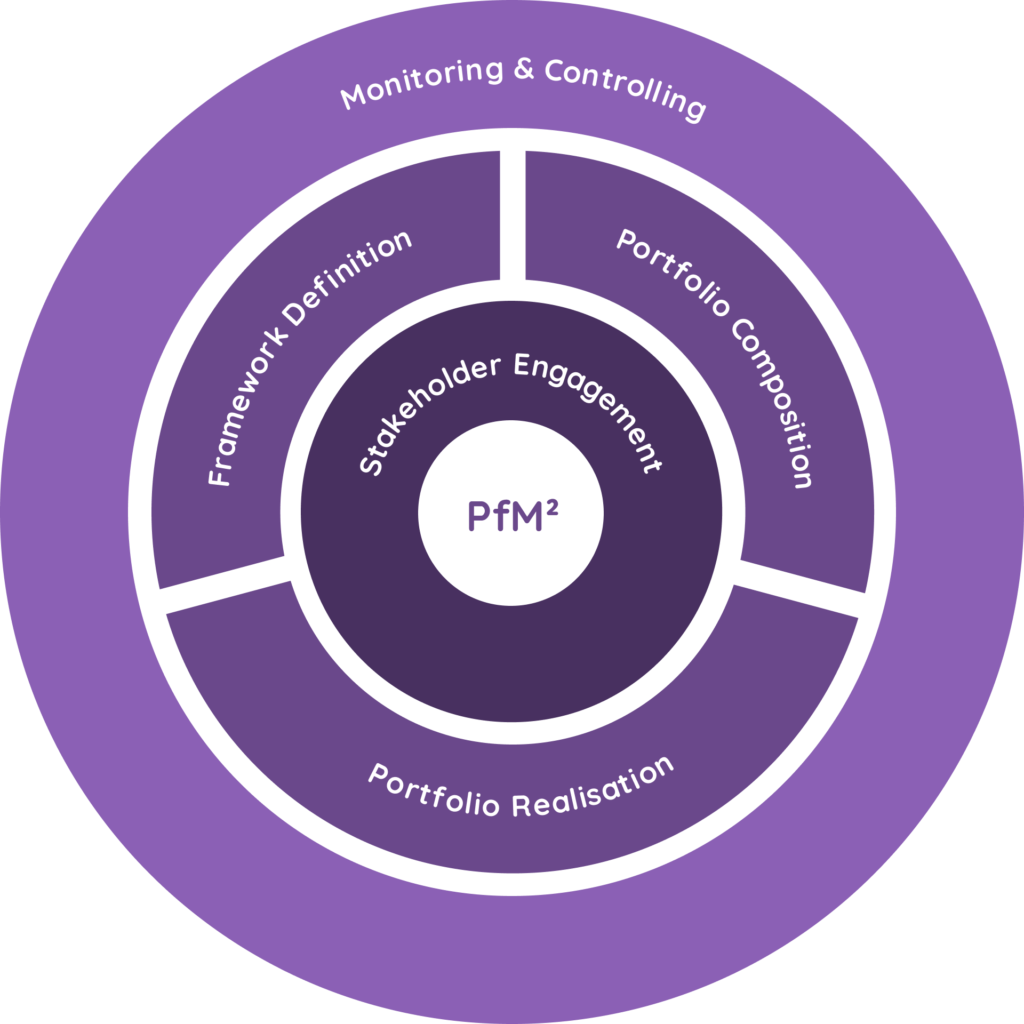

PfM² Portfolio Management comprises a Process Model and a Governance Model and its implementation is supported by a set of Mindsets and Artefacts.

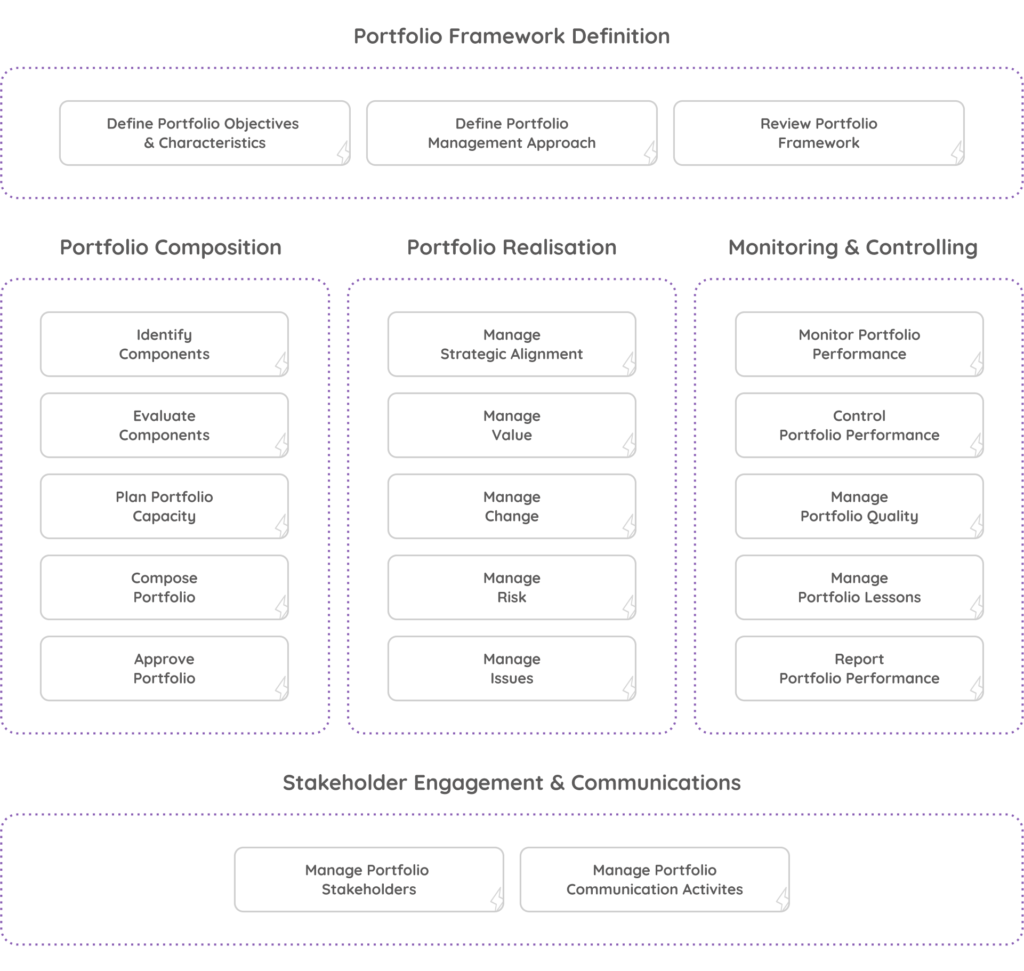

The PfM² Methodology describes portfolio management activities and organises them in five fiveprocesses: Portfolio Framework Definition, Portfolio Composition, Portfolio Realisation, Monitoring & Controlling, and Portfolio Stakeholder Engagement & Communication. Find below an overview of the PfM² processes and their activities.

The PfM² Processes

1) Portfolio Framework Definition: This process includes activities related to the definition of portfolio objectives, characteristics and management approach, including the definition of the governance bodies (roles) and their responsibilities, the management competences required, the management processes, and the portfolio artefacts. The framework should be periodically reviewed and can be adjusted in response to changes in the portfolio environment or a need for improvement.

2) Portfolio Composition: This process includes the activities related to identifying and evaluating portfolio candidates with a view to making investment decisions and allocating resources. These are recurrent activities that are performed periodically and based on the needs of the portfolio and the organisation.

3) Portfolio Realisation: This process includes the activities related to managing portfolio performance to ensure its components realize their objectives, and to analysing performance indicators to determine overall portfolio health. Portfolio components are temporary, and portfolio activities are performed continuously throughout the life of the portfolio. All portfolio components are monitored for the purposes of Portfolio Realisation.

4) Monitoring & Controlling: This process runs throughout the portfolio’s lifecycle and in parallel with all other portfolio processes. It includes the periodic collection and analysis of information that helps establish the portfolio’s performance based on pre-defined targets or indicators. It also includes identifying and implementing corrective actions to address deviations from defined target performances.

5) Stakeholder Engagement & Communication: This process includes activities related to effectively engaging stakeholders in the whole portfolio management process. All the portfolio communication activities, such as informing stakeholders about the performance of the portfolio are managed through this process.

The PfM² Portfolio Management Governance

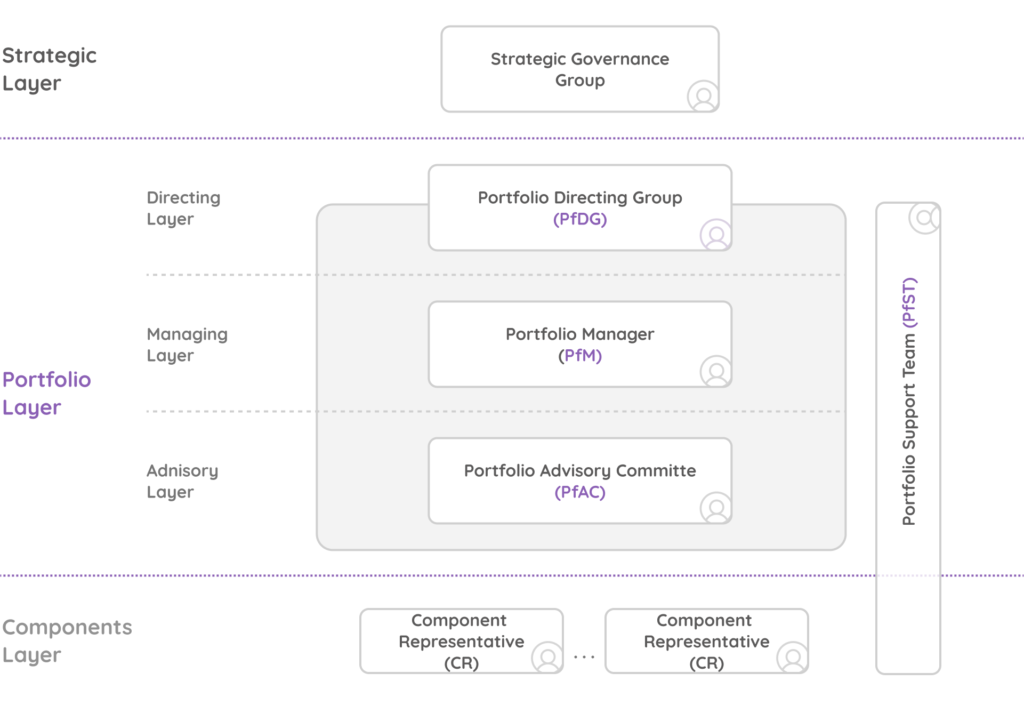

Governance is the management framework within which portfolio management decisions are made. It defines all standard portfolio roles and their associated responsibilities while describing escalation and reporting lines.

The Portfolio Layer connects the Strategy Layer with the Components Layer and is there to facilitate the implementation of the strategy through the selection and execution of a portfolio of components (i.e. (sub)portfolios, programmes, projects, services).

The Portfolio Directing Group (PfDG) is the highest authority in portfolio management. It is accountable for the effective implementation of portfolio management throughout the organisation, it maintains the big-picture view of all (sub)portfolios and provides them with strategic direction and leadership.

The Portfolio Manager (PfM) is responsible for the overall management of the portfolio through the application of the portfolio management procedures, as defined in the Portfolio Framework. The Portfolio Manager (PfM) reports to the Portfolio Directing Group (PfDG).

The Portfolio Advisory Committee (PfAC) advises the Portfolio Manager (PfM) on the effective management of the portfolio. It is active throughout the composition and realisation of the portfolio and based on the performance of the portfolio, it advises on appropriate corrective measures.

The PfM² Responsibilities Assignment Matrix (RAM) presents the responsibilities for each Portfolio Management activity and assigns them to the various governance roles. ARSCI = Accountable, Responsible, Supports, Consulted, Informed.

Note: Portfolio Support Office (PfSO), Component Representatives (CRs), Local Project/Programme/Portfolio Support Office (LPSO).

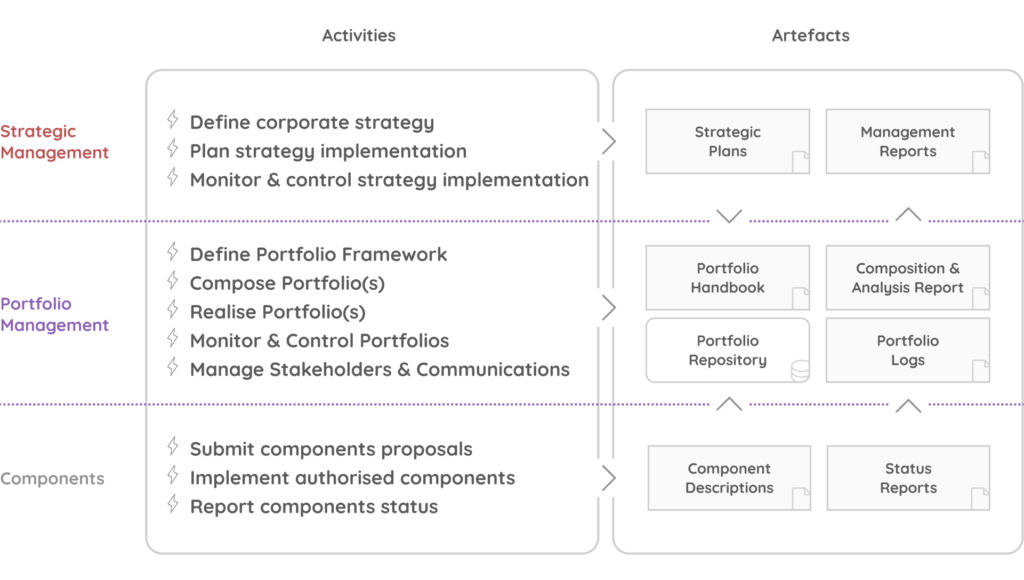

PfM² Artefacts

Documentation plays an important role in the management of a portfolio and should adhere to the quality standards of the organisation. The PfM² Methodology Artefacts:

- define the portfolio objectives and management approach (i.e. the Portfolio Handbook)

- capture the composition and the performance of the portfolio (i.e. Portfolio Analysis Report)

- facilitate monitoring & controlling (i.e. Portfolio Logs) and stakeholder engagement (i.e. Communications Management Plan)

- provide input from the Strategic Layer (i.e. Strategic Objectives and Work Plans) and the Components Layer (i.e. Initiation Requests and Status Reports).

The Portfolio Handbook defines the portfolio’s objectives and the portfolio management approach. The portfolio’s objectives capture the reason the portfolio exists. These are directly related to specific strategic and operational objectives of the organisation and guide the composition and realisation of the portfolio but also play a role in the selection of the appropriate management approach. The management approach describes, at the required level of detail, the tailored and customised portfolio management procedures to be executed and references specific tools and techniques to be used (e.g. for component evaluation and prioritisation). It also defines the governance structure, assigns the roles to people and defines their responsibilities in relation to their participation in portfolio management.

The Portfolio Composition & Analysis Report provides information on the portfolio’s composition, its performance, together with a view on the key portfolio components and their performance. The portfolio’s risks are discussed and recommendations to improve the portfolio’s performance are proposed. The Portfolio Analysis Report is a key working document that informs all stakeholders of the state of the portfolio and helps the Portfolio Manager (PfM) and the Portfolio Directing Group (PfDG) to make informed decisions regarding the optimisation of the portfolio.